Table of Content

In addition, you typically cannot claim accommodation expenses as tax deductions if you’ve chosen to work away from where you typically reside. Meals and accommodation costs covered by Living Away From Home Allowance are not tax-deductible. LAFHA is designed to compensate you for these meal and accommodation expenses incurred for work purposes. If your employer pays you an allowance to cover your working from home expenses, you must include it as income in your tax return.

If you are currently payrolling benefits in kind, you may continue to report expenses and benefits through your payroll. You may also continue to report expenses and benefits through P11D returns. Your employees will need to keep records of their purchase and claim for the exact amount. For more information on the strict tests that need to be passed in order to qualify for tax relief see the guidance on Employment Income. Self-employed independent contractors also get a number of deductions that are not available to employees, including those among the exceptions.

Response by poster Called AT T Cell the only phone I own.

For more information about what you can claim and the other methods available, see Working from home expenses. Businesses are doing everything they can to adapt to the new situation and many companies have been able to keep going. However, working from home is not available to all businesses or employees. If you are struggling to make payments to your employees when they aren’t able to work, you could get help with the recently launched employee furlough scheme.

A side note - if you’ve agreed with your employer to work at home voluntarily, or you choose to work at home, you cannot claim tax relief on the bills you have to pay. Some companies offer more to their remote workers, some offer less. However, as a bare minimum, HMRC states that your employer can pay you up to £6 a week (£26 a month) to cover your additional costs if you have to work from home. This allowance is free from tax, so you will receive the full sum.

Professional Aid and Services

In this case, the broadband is provided for business and any private use must be limited. If a broadband internet connection is needed to work from home and one was not already available, then the broadband fee can be reimbursed by you and is non-taxable. Get a statement from your employer that you’re working from home out the employer’s convenience if you are a home-based worker. Generally, the bills will count as an increased cost, as if you were at work in the office, you would not have been using them regularly. The crucial point is, however, that your employer must have required or asked you to work from home for you to be able to claim.

Franks Accountants helps small and medium business improve profitability and reduce any tax liabilities. We take the time to get to know you and your business, your challenges and expected outcome. You may also be looking to continue to have your employees work from home until the economy becomes a little more stable. Even with many finance teams operating remotely, there are many digital tools that mean expense management can continue as normal. It could be as simple as using a spreadsheet, or perhaps even specific accounting software or apps. Then, since the average working day is 8 hours, let’s say the room is in use for that period of time.

Income, deductions, offsets and records

SmartAsset’s free toolmatches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals,get started now. The scheme is designed to help people cover the extra costs of working from home, like energy bills and internet connections.

Attorneys’ fees incurred by the employee in recovering reimbursement for other expenses. Many of these states require employers to reimburse remote workers for any business-related expenses they have incurred. The federal Fair Labor Standards Act generally does not require that an employee be reimbursed for expenses incurred while working from home. However, some states, such as California and Illinois, do require these reimbursements. Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.

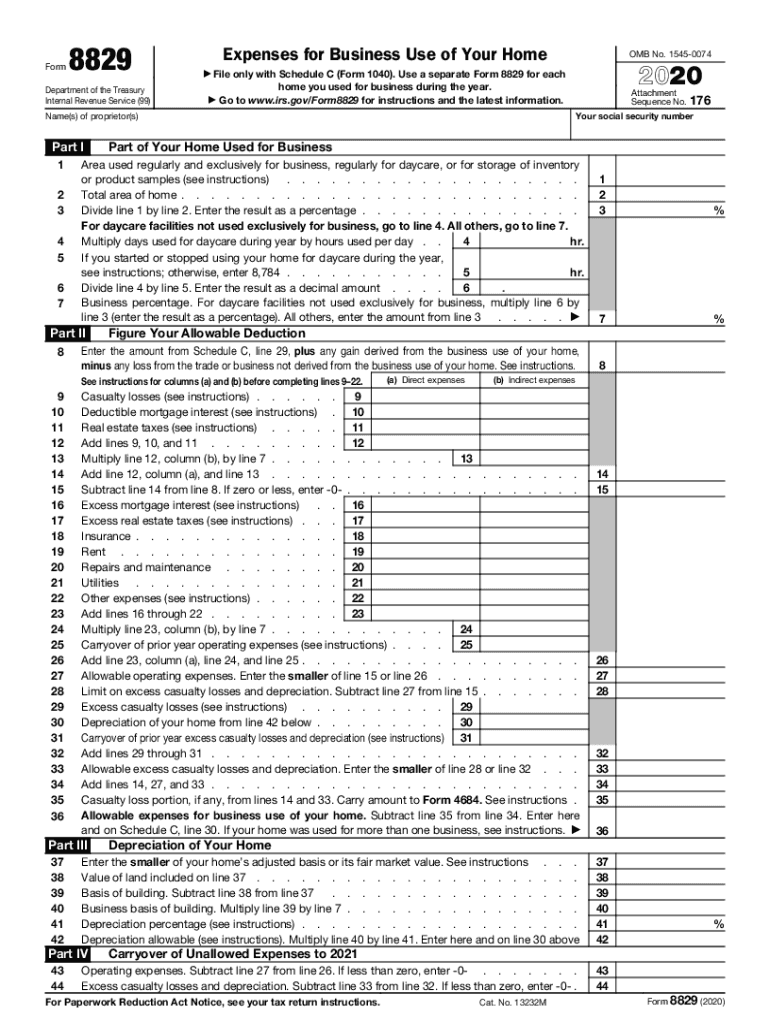

Also, work from home expenses can only be written off if they exceed 2% of adjustable gross income. As is the case with most tax matters, tax payers may be required to show receipts and other documentation of deductible expenses. Even if you work from home, there are days when you need to go out and meet clients. The deductibles include mileage allowance, airfare, parking, and lodging. Thousands of home-workers can still claim backdated tax relief on expenses incurred during the height of the Covid-19 pandemic.

The lists reflect only the types of expenditure that may typically be incurred in relation to maintaining a home office. State your policy about private use to your employees, setting out the circumstances under which private use is allowed. Aaron is a Chartered Accountant with over 15 years experience in the accounting industry. Aaron has been able to provide advice around structuring, cashflow, tax compliance and working with clients to develop strategies. This article is provided as general information only and does not consider your specific situation, objectives or needs. WealthVisory Accounting makes no warranties about the ongoing completeness or accuracy of this information.

Any decision of the employer not to recover the costs of private use is a commercial decision, rather than rewarding your employee. Significant private use should not be based on the time spent on different uses. It should be based on your employee’s duties and the need for them to have the equipment or services provided so they can do their job. There are some cases when it might be easier for employers to avoid expenses altogether and instead opt to provide a home office stipend. After all, your employer will be saving significant costs by arranging for their employees to work from home. You could negotiate the stipend to cover the cost of the equipment, internet, mobile or home phone, and, if applicable, renting your home office.

You take the square footage of your home office used exclusively for your self-employed business and multiply it by $5 per square foot up to a maximum of $1,500 per year. To get the biggest deduction possible, you may need to calculate your deduction using both the direct and simplified methods to see which one comes out ahead for your taxes. The Tax Cut and Jobs Act eliminated this deduction for W-2 employees from 2018 through 2025. If the employer fails to pay these reimbursements, the employee can file a wage and hour lawsuit. In limited circumstances, you may also be entitled to claim occupancy expenses.

Being reimbursed for an expense is almost always better than taking a deduction for the same expense on your taxes. The other way to claim the home office deduction is by using the direct method. This involves tracking all of your home office expenses in addition to any costs related to repairing and maintaining the space. Further, you can claim deductions for a portion of other expenses based on the proportion of the space to the rest of your residence. To understand more about how you can claim tax deductions when working from home, take a look at the following tax tips for employees. Well, the IRS reserves them for self-employed independent contractors.

No comments:

Post a Comment